GTBank appoints female MD

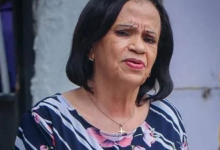

GUARANTY Trust Bank (GTB), has appointed the first female Managing Director, Mrs Miriam Olusanya.

She takes over from the former Managing Director, Segun Agbaje.

It said under the terms of the re-organisation, a new operating company has been established and amendments made to the articles of incorporation for a corporate name change.

“The corporate name of Guaranty Trust Holding Company Plc and GTCO Plc will be used by the newly established operating company.

It reads:

“The newly established Guaranty Trust Holding Company Plc is also pleased to announce its new Board of Directors as well as changes to the Board of its banking subsidiary, Guaranty Trust Bank Limited. All the appointments have been approved by the Central Bank of Nigeria and disclosed to the Securities and Exchange Commission and the Nigerian Exchange Group.

“Guaranty Trust Holding Company Plc (“GTCO Plc”) will be governed by a Board of Directors comprising, Mr. Sola Oyinlola as Chairman of the Board and Mr Segun Agbaje as the Group Chief Executive Officer, Mr Adebanji Adeniyi as Executive Director, Mrs Cathy Echeozo as Non-Executive Director, Mr. Suleiman Barau and Mrs. Helen Bouygues as Independent Non-Executive Directors,” the statement said.

It added that “The Banking subsidiary, Guaranty Trust Bank Limited will be governed by a Board of Directors comprising, Mr Ibrahim Hassan as Chairman of the Board, Mrs Miriam Olusanya as Managing Director, Mr Jide Okuntola as Deputy Managing Director, Mr Haruna Musa as Executive Director, Mr Olabode Agusto as Independent Non-Executive Director, Ms Imoni Akpofure and Mrs Victoria Adefala as Independent Non-Executive Directors.”

Commenting on the completion of the Corporate Reorganization, Mr Segun Agbaje, the Group Chief Executive Officer of Guaranty Trust Holding Company Plc, said: “We believe that a Holding Company Structure will allow us take advantage of new business opportunities in the emerging competitive landscape and strengthen our earnings base.

“We are very excited to get started on the next phase of our incredible journey to driving Africa’s growth by making end-to-end financial services easily accessible to every African and African Businesses by leveraging Technology and Strategic Partnerships.

“As a bank, we were always looking to meet every customer need; with our corporate reorganization, we will be able to do more to help our customers thrive in this new world of digital technologies and unprecedented”.